We are witnessing the greatest wealth transfer in the history of mankind. But what does it mean for you, your family and wider society?

Globally, millennials are set to inherit $90tn by 2044. To put that number in context; the world economy will reach $108tn by the end of this year, and the Mag 7 are currently valued at $16.6tn.

As canonical literature (Shakespeare's King Lear, Thackeray's Vanity Fair and Austen's Sense and Sensibility) teaches us, the transfer of wealth can be a fraught process.

It often involves skullduggery, gamesmanship and crushing disappointment. At its most entertaining, the dry tinder of anticipated enrichment erupts into internecine warfare.

This time around it won’t just be aristocracy and High Net Worth (HNW) individuals - those in the $100m plus wealth bracket - scrapping for legacies, but also “normal people”.

It's estimated that more than 600m individuals worldwide stand to inherit assets worth more than $100,000, ranging from : property, shares, Parmesan cheese, antique furniture, collectible art, rare whiskies, Stradivarius violins and raunchy old love letters you wish you hadn't read.

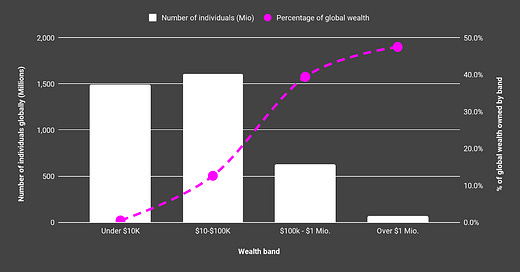

The air gets thinner and the concentration of wealth greater as you go up the wealth pyramid. It astounded me to learn that just 60m people (equivalent to the population of Italy or 0.78% of the world’s population) own nearly 50% of the world's total wealth.

Let that sink in for a moment.

We now live in a inheritocracy

Welcome then to the inheritocracy, a new social class funded by the bank of mum and dad, which sometimes features generous grandparents and long lost relatives1.

You will recognise it when you see it, and you yourself might have been a beneficiary.

It looks like a discreet five or six figure financial gift that helps a son or daughter get onto the property ladder.

Or if you come from more affluent stock, a meeting with a tasseled loafer-wearing wealth manager in a Mayfair townhouse, where the carve up of a lucrative estate is revealed to expectant heirs. (Discreet and equally expensively furnished offices in Geneva, Zurich or Luxembourg are also available).

At the top end, savvy Ultra High Net Worth (UHNW) families execute carefully choreographed succession plans. The less savvy, or those with a particularly dark sense of humour, don’t leave a will at all, and let chaos ensue once they are safely entombed.

Heir conditioning

A succession plan often begins with a slow handing over of the reins to a family business, like Bernard Arnault is doing with his five adult children at LVMH, or as Mukesh Ambani, Asia’s richest man, is doing at Reliance.

Ambani has given his three children board seats, appointed them mentors (old hands who he entrusts to guide them until they are ready to run alone), and has placed them in business divisions which suit their strengths.

Arnault’s eldest daughter runs Dior, the groups most second most valuable brand after Louis Vuitton, and his third son Alexandre (32) was recently announced as deputy chief executive of Moët-Hennessy, the €293bn group’s wines and spirits business.

What is clear is that before anyone gets handed the keys, they will need to prove that they can drive up the share price, whilst driving responsibly.

Which is why the clued up super rich apply controls.

The reproduction of social inequality

Whatever form it takes, wealth transfer reproduces social inequality because those who have more to begin with have more to pass on. Money begets money. The cycle continues, if the heirs are good stewards of that wealth.

That’s a big if, because heirs have been known to be frivolous, wasteful and irresponsible with legacies.

It's no coincidence that some variation of the idiom "clogs to clogs in three generations" exists across cultures and languages.

My favourite is the Italian “from stables to stars to stables” i.e. the first generation builds wealth, the second generation is inspired to preserve it by witnessing the hard work of their parents, and the third generation - having grown accustomed to it and not having seen the hard work that went into creating it - squanders it. (This is the well-known archetype of the entitled brat and often goes hand in hand with an expensive drug habit).

Our fascination with fictional families like the Roy's from Succession, or their real-life counterparts like the Murdoch's, is that none of the heirs seems a suitable replacement for the overbearing patriarch. And so the old bastard clings on, pitting his children against each other, giving with one hand and taking with the other, cruelly undermining and ridiculing his eldest son until he can no longer escape his own mortality.

Apparently the “hanging on until the bitter end” motif in Succession comes from the true story of Sumner Redstone, the 94 year old chairman of media conglomerates Viacom and CBS. When he was no longer able to speak due to his advanced age, he communicated with his Board via an iPad containing three pre-recorded audio clips : “yes”, “no”, and “fuck you”. I thought you might enjoy that little detail.

Why is talking about wealth transfer so taboo?

Inheritance is taboo because many of us have done nothing to deserve the wealth we inherit. It sits awkwardly alongside the professed belief in a meritocracy and that we are the agents of our own success.

For those of us who believe in social equality and cohesion, it poses a troubling moral question:

How do we feel about living in societies that are becoming more unequal, and where fewer and fewer wealthy individuals own a larger and larger share of the pie?

The chart below brings this home. The 11 trillion in combined wealth owned by a global billionaire class of just 2,638 individuals is equivalent to the combined GDP of Japan, India and France (population 1.64 billion).

So back to the question of gross social inequality.

Those who have the most to gain tend to believe that they are entitled to the spoils of previous generations' hard work and that the state should keep its greedy hands off. The French have a saying that the older you get the more you think with your head, and the less you think with your heart. This feels like a self interested “head issue”.

Which is why inheritance tax is such an emotive topic, and why "tax-efficient" succession planning is now a core part of wealth management.

At the other end of the spectrum, UHNW individuals like Warren Buffett and Bill Gates have signed the Giving Pledge, promising to give away at least half of their wealth to charity. (Some go further, pledging up to 99%). Yes, we should take this with a healthy pinch of salt, because all philanthropy has a quid pro quo; the mega-rich buy themselves good PR and political influence.

Still, it is better to have someone like Bill Gates or Warren Buffett giving billions to fund research into curing diseases or tackling worthy social causes than to have them spending it on yachts, penis-shaped rockets and muscle tees like Jeff Bezos.

The gini (coefficient) is out of the bottle

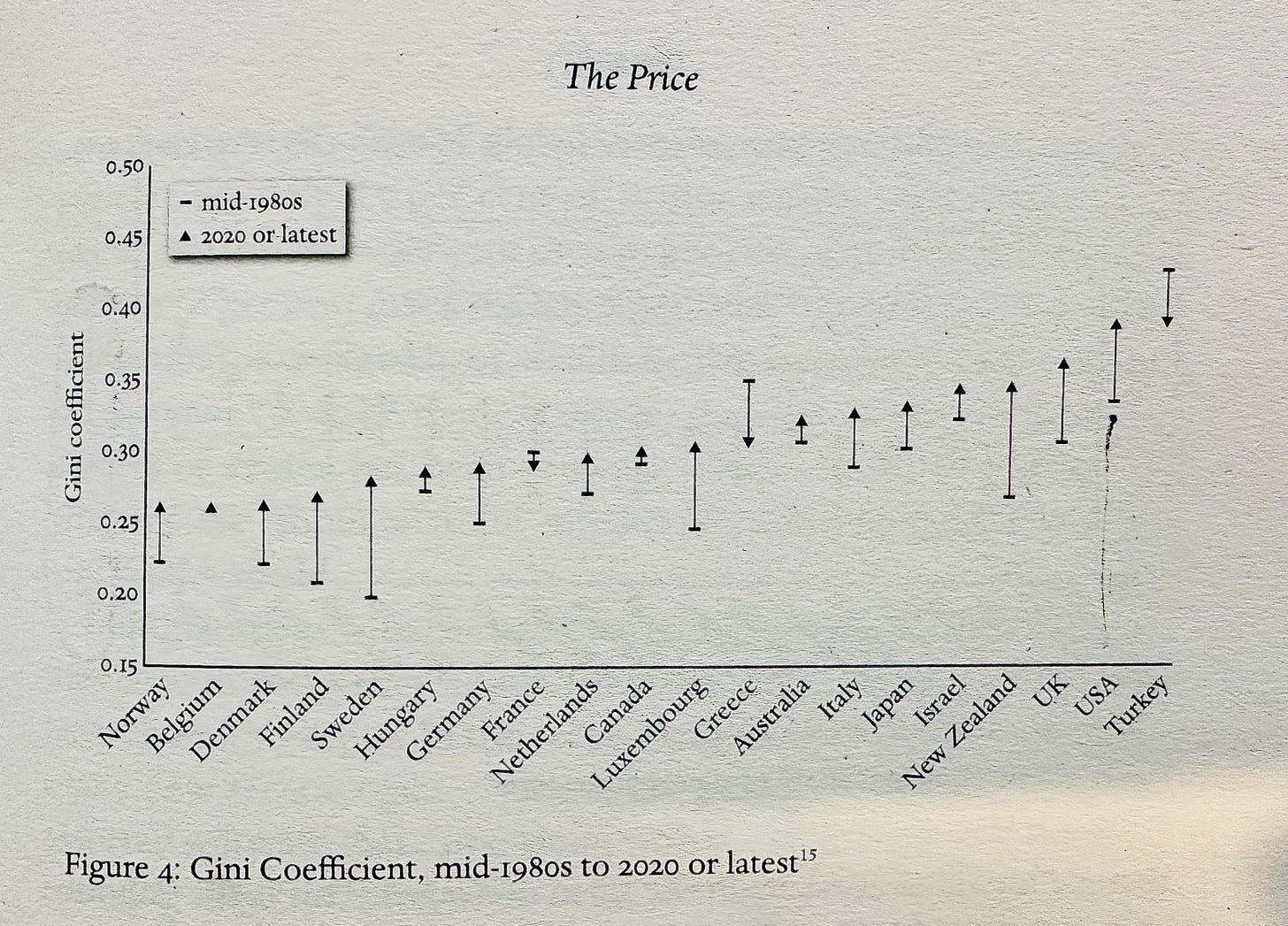

The sad truth is that Gini coefficients will continue to rise, and rise more quickly, in all developed nations, even in those with highly progressive tax systems like Sweden. (Note : The higher a gini coefficient the more unequal a country)

As Albert Einstein said, and Thomas Piketty identified in Capital in the Twenty First Century,

"Compound interest is the eighth wonder of the world"

As we enter this new phase of unprecedented wealth transfer, more lucky recipients than ever before will benefit from windfalls that compound into ever greater sums.

On a macro, societal level, wealth transfer is problematic, and that is a topic that deserves to be explored in more detail in a separate post.

Now, I want to zoom in on the two stakeholders who stand to gain the most from the largest wealth transfer in history: families and wealth managers. This is because both groups still face a number of challenges.

The wealth management opportunity

Wealth managers structure their services around the same 'core pillars': diversification, risk management, tax efficiency and estate planning. And broadly invest in the same asset classes : real estate, equities, credit, maybe a bit of hedge funds and VC.

Add-ons tend to start at the $1-2m HNW segment and include things like social impact (i.e. philanthropy, which can include the creation of foundations or endowments, which, not coincidentally, have tax advantages).

Where the air is thinner, the offering becomes much more tailored and differentiated to provide more support across multiple jurisdictions, complex structures and specific projects.

Disclaimer: I'm not a wealth management expert, I just wanted to point out the bleeding obvious, which is that there will be a lot of new wealth looking to connect with a lot of very eager wealth managers, and from the outside the value proposition looks boilerplate for so-called affluents (those with $100k - $1m in assets) and for HNWs at the lower end of a very broad $1-100m segment.

There is a huge opportunity to stand out in the < $50m segment and it’s particularly interesting to look at one underserved part of the wealth puzzle; mediating conversations and family dynamics around wealth transfer.

HSBC reports that:

36% of families regularly talk about their wealth transfer plans, with this being more likely for those who are currently active in the family business or are first-generation entrepreneurs who have involved the next generation.

However, this leaves almost two thirds (64%) who haven’t yet spoken to their family about their wealth succession plan. Notably, 8% say they never intend to, and this rises to 13% for those with investable assets over $10m.

This data suggests that not enough families are having those important, proactive conversations. These are, of course, delicate and potentially fraught so it seems obvious to me, at least, that professional facilitation and even a family psychologist might help. In some cases, conflict resolution support may be needed to help overcome an impasse and work towards an outcome where everyone is equally unhappy.

As Tolstoy observed, and as Succession teaches us, happy families are all alike, but each unhappy family is unhappy in its own way. It's time wealth managers did more to address this psychosocial reality, whilst continuing to deliver attractive returns.

For conceptual clarity, the inheritocracy subsumes other -ocracies, like plutocracy (wealth passed on by the super rich) and kleptocracy (wealth passed on by families who have plundered the mineral wealth of their nations to enrich themselves, and successfully laundered this money in Western financial centres i.e. the Marcos, Dos Santos, Mobuto, Abacha and Suharto families, and nearly all Russian Oligarchs). For a fuller list that I made earlier, go here.

it is much more profound, people think their property rights & assets SHOULD be safe? Why?

https://x.com/profstonge/status/1903501612305219925